Are you sick and tired of dealing with damage caused by leaking roofs and broken pipes every time there’s a storm?

Then it’s high time you filed a claim against your homeowner’s insurance policy. In case you didn’t know, homeowners insurance actually provides coverage for water damage!

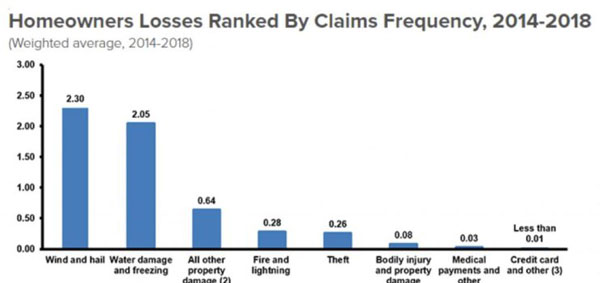

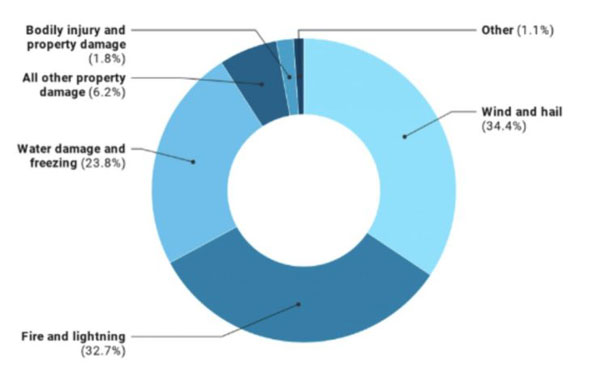

In fact, the Insurance Information Institute states that water damage was the second most frequent insurance claim filed by homeowners from 2014 to 2018. The numbers will probably be higher in 2020 and beyond.

If you’ve been suffering in silence as you watch the water from burst pipes or your leaking roof ruin your expensive furniture, now is the right time to call your insurance company.

In this post, we answer the question, “Does homeowners insurance cover water damage?”

Here’s an outline of what we are going to cover in the course of this article:

- Learning the basics of homeowners insurance and water damage coverage

- Understanding the types of water damage covered by homeowners insurance

- What types of water damage are not covered by homeowners’ insurance?

- Tips on how to prevent water damage in your home

- How to file a successful water damage insurance claim

- Possible reasons why your claim was unsuccessful

- So, what’s next? Where to get water damage coverage

Without further ado, let’s get started…

Learning the basics of homeowners insurance and water damage coverage

Homeowners insurance is one of those inevitable expenses that come with owning a home. It provides much-needed protection against various risks that could lead to financial loss or damage to your property.

Under homeowners insurance, we have several add-ons, riders, or endorsements that offer more protection than the standard coverage. These add-ons help to fill in the gaps where your basic policy cannot provide coverage.

One add-on that every homeowner should consider purchasing with their home insurance policy is water damage coverage. It might seem obvious that water damage is included in homeowners insurance, but this depends on the insurer.

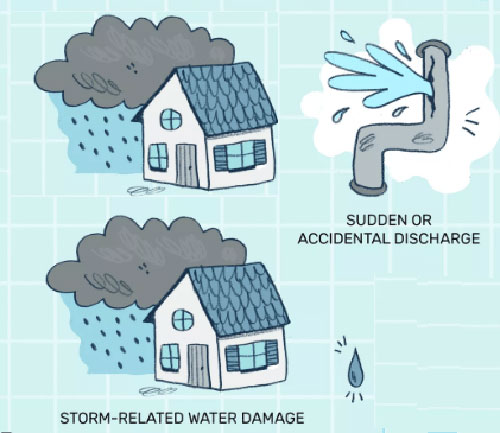

As the name implies, water damage insurance is a type of supplementary policy that protects your home from sudden or accidental water damage.

Dealing with water damage can be extremely frustrating. However, with water damage insurance, you can rest assured that your property is safe from ruin. From burst pipes to accidental overflows, this insurance policy provides coverage for any damage caused by excess water flow.

However, you should note that insurance companies do not cover water damage caused by negligence or poor maintenance. You should ensure your pipes and household appliances, like washing machines, are in good shape, before trying to file a claim for compensation.

Understanding the types of water damage covered by homeowners insurance

Knowing what’s covered and what’s not in case of water damage can sometimes be a little confusing. After all, not all homeowners insurance policies provide coverage for water damage.

Therefore, it is always a good idea to check with your insurer before you commit yourself to buying a particular policy.

Nonetheless, we have made things easier for you by listing some of the most common types of water damage covered by homeowners insurance.

1. Burst Pipes

One of the most common causes of water damage is a burst pipe. A sudden increase in pressure can cause your pipes to rupture, subsequently allowing the released water to cause damage to your property.

Since this is a sudden and an unexpected peril, your insurer will have no choice but to compensate you for the damage.

2. Water Damage from a Roof Leak

You can file a successful claim if a storm causes your roof to leak, leading to property damage. However, to qualify for compensation, you must ensure that the leak is not the result of gradual damage.

Insurance companies are very specific that if a storm damages your roof, you must fix it as soon as possible to avoid further water damage, increasing your chances of receiving compensation for the damage already caused.

3. Water Damage after a Fire

Any water damage resulting from the process of extinguishing a fire is usually covered by homeowners insurance.

However, the insurance company will first investigate the cause of the fire before deciding to reimburse you. If the fire was a result of your negligence, you shouldn’t expect your claim to be successful.

4. Overflow of Appliances

Your homeowners insurance should cover the costs of repair for any damage caused by water overflow from household appliances, such as washing machines. However, the overflow should be sudden or accidental, and not a result of poor maintenance or negligence.

5. Leaks from Aquariums and Waterbeds

Water damage caused by leaks from water-filled items like aquariums and waterbeds may also qualify for compensation using your homeowners insurance policy.

Nevertheless, you must check with your insurer before signing the declaration documents to confirm whether or not the policy covers these events. This will prevent last-minute disappointment when filing a claim.

6. Water Damage from Vandalism

Excess water after a storm may find its way into your home through vandalized sections, leading to extreme water damage.

Nonetheless, for you to qualify for compensation, the vandalized sections must not be easily noticeable. The insurer might be hesitant to compensate your losses if you were in a position to repair the damaged areas.

What types of water damage are not covered by homeowners insurance?

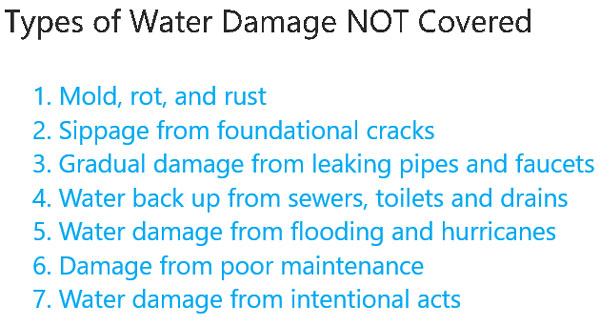

Did you know that homeowners insurance does not cover water damage caused by flooding?

Well, it also does not cover water damage caused by poor maintenance and negligence. Here are additional types of water damage not covered by homeowners insurance.

1. Mold, rot, and rust

Homeowners insurance typically does not cover damage caused by mold. This is because mold damage is more or less a result of neglect. Mold, rot, or rust are only considered for coverage if they are related to specified perils under your homeowners insurance policy.

2. Seepage from foundational cracks

It is always a good idea to carry out a thorough home inspection before purchasing a house. Issues with broken pipes, faulty sewer lines, foundational cracks could cost you more in the long-term.

In this case, if water finds its way into your house and causes damage, you should not expect payment from your insurer.

3. Gradual damage from leaking pipes and faucets

If you notice any broken pipes, leaking roofs, faulty faucets, or cracked walls, you should repair them immediately to prevent further damage to your property.

If left unabated, the damage could become irreversible over time. The reason for this is simple: homeowners insurance does not cover gradual damage.

4. Water back-up from sewers, toilets, and drains

Homeowners insurance does not cover water damage caused by back-ups from outside sewers and drains. For this, you have to purchase an extra policy tailored for water back-ups. But first, make sure you call a sewer expert to mitigate the problem.

5. Water damage from flooding and hurricanes

If you live in a flood-prone area, you are better off purchasing special coverage for flood-related damage. This is because flooding and hurricanes are considered natural disasters and they are not covered by homeowners insurance.

6. Damage from poor maintenance

Homeownership comes with many responsibilities, one of which is taking care of your house by carrying out routine repairs and maintenance. Your insurer expects you to maintain your home, should not expect compensation for water damage caused by negligence or poor maintenance.

7. Water damage from intentional acts

If you decide to set your house on fire or destroy your property intentionally, hoping to get compensated for water damage. Sorry! You won’t get paid. Homeowners’ insurance does not cover water damage caused by intentional acts.

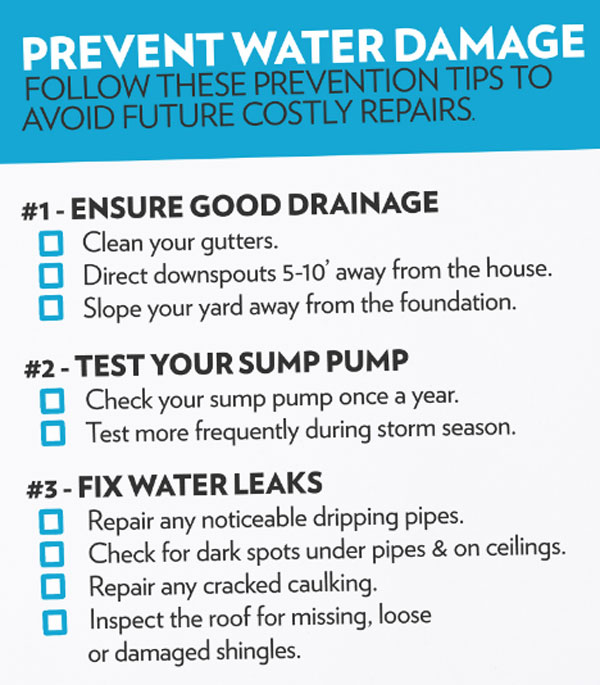

Tips on how to prevent water damage in your home

Whoever said, “prevention is better than cure,” was 100% right. After all, the best way to protect your property from water damage is to prevent it from happening in the first place!

You must make a point of monitoring your home for cracks, broken seals, burst pipes, and faulty faucets to reduce the chance of water damage. Also, ensure that the heater is functioning optimally during winter and avoid leaving the dishwasher or washing machine running while you are away.

Here are a few additional tips on how to prevent water damage in your home:

- Seal all cracks to prevent seepage

- Check exposed pipes for cracks and leaks

- Check and replace faulty faucets

- Test and maintain your sump pump

- Control humidity levels in your home

- Shut off your water valve in case of any problems

- Repair burst pipes immediately

- Replace or repair malfunctioning kitchen appliances

- Inspect your water heater annually

- Install water leak detectors

How to file a successful water damage insurance claim

Filing a claim for water damage against your homeowners insurance policy can sometimes be a long and frustrating process. You first need to convince your insurer that the damage was indeed not the result of negligence or poor maintenance.

In this section, we share some tips on how to file a successful water damage insurance claim. Here are the steps:

- 1. Take pictures of the damaged area as evidence

- 2. Contact your insurance company and inform them of the damage

- 3. Shut off the water supply to prevent additional damage

- 4. Contact a plumber or a repair service to mitigate the problem byg doing temporary repairs, and retain all records of repair

- 5. Remove all wet and ruined furniture, clothing, and other items, and keep them as evidence for your claim

- 6. Move undamaged items to a safe location

- 7. Remove excessive water from your home

- 8. If the damage occurred due to vandalism or illegal activities, file a report with the police

Make sure you understand all the nitty-gritty details of your coverage before filing a claim. You can significantly increase your chances of success if you know and understand everything that is covered by your policy.

Also, do not forget to report the incident as soon as possible and safely store all the evidence until the insurance adjuster arrives.

Possible reasons why your claim was unsuccessful

As discussed earlier, filing a successful water damage claim on your homeowners insurance is not easy.

Whatever the outcome, make sure you ask your insurer for a full explanation as to why you claim was unsuccessful. You can also consider seeking a second opinion from an independent insurance agent. Do not be afraid to ask for clarification if you believe you are right.

Some of the possible reasons why your claim was denied include:

- Filing a claim against uncovered perils like flooding or hurricanes

- Not paying the required deductible to qualify for compensation

- Not having sufficient evidence to prove water damage

- Water damage caused by lack of maintenance and negligence

- Filing a claim for items damaged by intentional acts

- Not maintaining records of repairs

So, what’s next? Where to get water damage coverage

Purchasing homeowners insurance is a necessity rather than a luxury. However, home insurance policies are not the only ones that provide the extra coverage that you might need.

If you want to protect your home from water damage and other perils it is crucial to engage an insurer you can trust and rely on at all times.

Old Harbor Insurance is your trusted partner for all your insurance needs. We offer a wide range of insurance policies, including water damage coverage, to cover your every need.

Whether you need advice on the best homeowners insurance, or your want to purchase a policy for your household, we are always ready to answer all your questions.

Call us today or visit our website to learn more about our water damage coverage!